31 Jul The Best Freelancer Accounting Tips & Advice

The Best Freelancer Accounting Tips & Advice

One of the most vital determinants of success as a freelancer is how you manage your finances and sort your freelancer accounting.

It’s even more vital for you to start your finances off on the right foot if you’re a newbie.

Taking the bold and respectable decision to make a living by using your creativity isn’t an excuse to turn a blind eye and hope your finances sort themselves out.

As a freelancer, you’re a business owner, and you need to manage every aspect of your business to ensure that it’s a sustainable operation.

We have compiled a few freelancer accounting tips that’ll help you to sort your finances better and keep your business running even during dry spells.

1. Don’t Sell Yourself Short

Most creatives, such as designers and artists, don’t believe they should be thinking about accounting terms like spreadsheets, balance sheets, and cash flow forecasts.

Hence, most designers do only the bare minimum of freelancer accounting, and even that is often at the last minute when their tax deadline beckons.

There are plenty of misconceptions about artistic people and money in our society.

Regrettably, many design freelancers have internalised the stereotype.

As a freelancer in the UK, you need to overcome these mental hurdles and see accounting and finance management as part of your job description.

You’re as much a business owner as the person running the store down the street.

2. Separate Personal and Business Funds

Your business income is not your personal income even if you pay yourself with it.

So, when creating an identity for your brand, you need to go as far as opening a separate bank account for your business.

This will make it easier to track your cash flow and sort them into personal and business funds.

In the case of a tax audit by HMRC, you will also have nothing to worry about.

While you need to have a business account, it’s also worth noting that for freelancers, an online bank is more suitable.

They are often free to create and have no minimum balance requirements as opposed to traditional banks.

Also, freelancing comes with a variable income, and if you’re just starting, you might not have the extra money to pay bank charges.

3. Create a Budget

Preparing a budget might seem a little old school to you, but it also means you’re smart.

A budget will help you to plan out your monthly business income and expenses even before the need arises.

It gives you a clear picture of where your money is going so that you can plan what you can and cannot do with your business.

You get to see where you’re overspending and underspending each month.

The best part of having a budget is that it allows you to spend as much as you earn while also giving you room to allocate extra money to your savings.

4. Track Your Income

Tracking income is essential for every freelancer.

While you might love graphic design, writing, or whatever else it is you’re doing, you need to make money to survive.

It’s not enough to have a separate business account.

You must also know how much you’re bringing in and how much your time is worth.

You can either choose to record income as you receive it (cash basis) or record impending payments (accrual).

5. Track Your Expenses

There are tonnes of expenses you can get tax relief for, and to take full advantage, you need to track your costs no matter how small.

Even the most professional of freelancers can have trouble keeping up with all of their expenses.

However, tracking your expenses is vital, especially at the end of the year when you have to do the paperwork for your taxes.

The most crucial practice in expense tracking is keeping receipts.

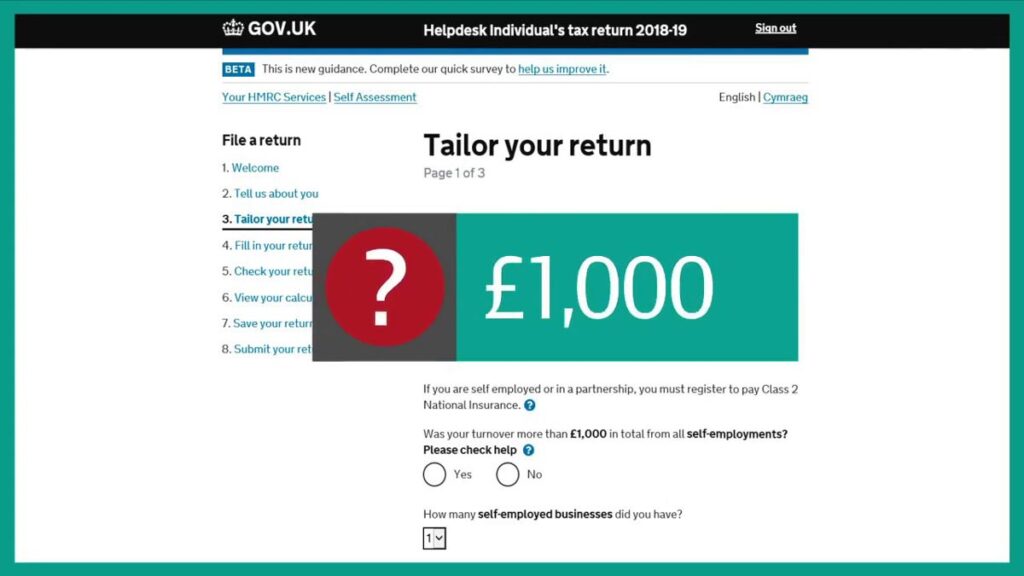

6. Set Aside Money for Tax

Being your own boss also means paying business taxes.

Taxes can be stressful for anyone and even more stressful for freelancer accounting, but it doesn’t have to be that way.

Since you already know you need to pay taxes at the end of the year, all you have to do is set aside a percentage of your money on an ongoing basis to pay your tax when it’s due.

If you want to determine how much you should be putting away for your taxes, it’s best to speak to an accountant in your jurisdiction.

To be safe, set aside at least 30% of your income into a separate account each month for taxes.

7. Plan for Dry Spells

Freelance work is unpredictable.

Even if you have a regular client base, there will come a time when you won’t get jobs as often as usual.

Consequently, you need to brace yourself for the inevitable.

Dry spells can last for weeks or even months, but you have nothing to worry about because every freelancer goes through this phase.

Some are just more prepared for it than others.

Here are a few things you can do to prepare yourself for dry spells.

- Cultivate the habit of saving: This is very important in life, whether you’re a freelancer or a business owner. It’s a no brainer.

- Networking: This is a necessity because it almost guarantees a reliable stream of work and a massive roster of potential clients to reach out to during dry spells

- Reach out to former clients: retaining customers is more comfortable compared to finding new ones. During a dry spell, you can always send a mass email notifying them of your availability for work.

- Invest in side projects or a personal business that brings in passive income.

8. Bookkeeping

Most freelancers, especially those whose work requires a significant amount of brainstorming such as with logo designers often burn out before they can do proper bookkeeping.

It’s really easy to push bookkeeping to the bottom of your to-do list, but the longer you do that, the more work you’ll have to do at the end of the year.

It’s always advisable to create at least an hour every week to check on payments, outstandings, and calculate your income.

Tax laws in the UK require business owners to keep transaction records for at least five years.

You should have a well-organised account statement folder for the appropriate business documents.

It’s also mandatory for self-employed individuals in the UK to submit an SA100 form alongside other relevant documents.

9. Get Insured

According to a 2016 report on freelancer accounting by Upwork, about 20% of full-time freelancers are uninsured.

It doesn’t matter if you’re young or old, working without coverage can lead to substantial financial distress, especially if you have a medical condition or an emergency.

It’s always safer to have health, car, or life insurance.

10. Carry Out Regular Budget and Cash Flow Audits

Having a budget is meaningless if you don’t follow up on it.

You need to get into the habit of checking in with your budget and comparing it to your cash inflow and outflow.

Set realistic goals from the start but be open to reshuffling your budget in case of unforeseen circumstances.

Cash flow audits will also help you notice a rise or fall in your income and expenses so that you can make the necessary changes to your operations.

11. Schedule Your Invoices to Ensure Timely Payments

It’s good practice to notify clients before you start a project about your payment conditions.

Invoice immediately after the successful completion of a project.

Most people who hire freelancers have already set the budget for the work and should have no problem paying immediately after delivery.

Once in a while, you’ll encounter clients that don’t pay on time, and you need to reach out to them and avoid late payments.

Prompt invoicing and regular follow-ups will help you to develop a healthy financial habit that will promote your business and allow it to grow.

12. Use Freelancer Accounting Software

Accounting software such as Mint, QuickBooks, Freshbooks, and Every dollar are the bookkeeping trends these days.

They are user friendly and will help you to achieve the same result as a traditional accountant.

They can keep track of your banking accounts, plus they have an invoicing system and a tax projection feature that’ll give you an analysis of your tax payments when due.

13. Seek Advice From a Professional Accountant

Make no mistake to think you know it all because you manage your finances well.

Your accounting knowledge is most likely experienced-based and not professional or academic.

Therefore, some situations may warrant you to consult a professional accountant.

Accountants can give you helpful tips on how to manage your accounts and taxes. They also provide excellent business advice.

Conclusion

Sorting your accounting and carrying out regular bookkeeping as a freelancer will provide you with the following benefits:

- Keep you in the loop of everything going on with your finances and allow you to make informed decisions

- Enable you to track every expense, income, and payments you made

- Always prepare you for an audit

- Help you to recognise potential irregularities you may have missed during operation

Managing money as a freelancer can be time-consuming and stressful if you’re not used to it.

However, the benefits of being organised with your freelancer accounting will be worth a lot more than the effort.

Last update on 2020-08-01 / Affiliate links / Images from Amazon Product Advertising API